Journal Description

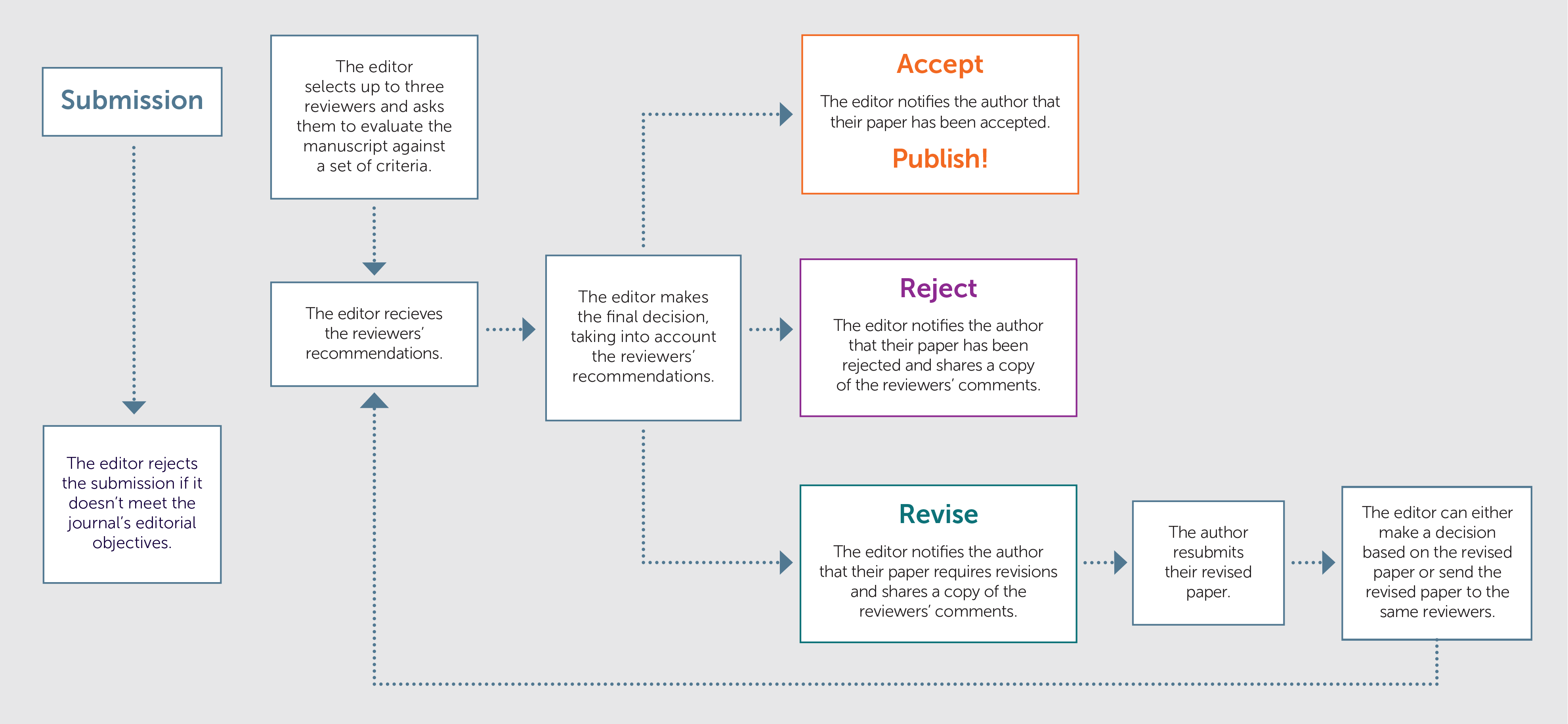

Advances in Taxation Research is a double-anonymous peer-reviewed journal published by the Yayasan Pendidikan Bukhari Dwi Muslim. Published three times a year, in January, May, and September, with E-ISSN 2985-7554. This journal engages in a double-anonymous peer review process, which strives to match the expertise of a reviewer with the submitted manuscript. The submitted manuscript is first reviewed by an editor. It will be evaluated in the office, whether it is suitable for Advances in Taxation Research aims and scope or has a major methodological flaw and similarity score by using Turnitin, the minimum number and age of references that we require, template suitability. The manuscript will be sent to at least two anonymous reviewers (Double Blind Review). Reviewers' comments are then sent to the corresponding author by the editor for necessary actions and responses. The suggested decision will be evaluated in an editorial board meeting. Afterwards, the editor will send the final decision to the corresponding author. All articles published in Advances in Taxation Research are published Open Access under a CC BY 4.0 license.

Peer Review Models

Current Issue

Vol. 3 No. 3 (2025): June - September

View All Issues